- #Blue acorn ppp loan login drivers#

- #Blue acorn ppp loan login update#

- #Blue acorn ppp loan login full#

- #Blue acorn ppp loan login plus#

After your PPP covered period, you’ll resume collecting unemployment benefits. The Owner Compensation Replacement are going to be considered to be income for unemployment purposes, so it’s not very compatible with unemployment benefits or the PUA. How does PPP Loan work with PUA or unemployment benefits? Until further guidance is published, we recommend working under the idea that you simply will got to report the claimed OCR as income on your 2020 income tax return. Brett N: I want to thank Blueacorn for the opportunity for a PPP Loan. While the CARES Act indicates that forgiven PPP amounts aren’t taxed and may be treated sort of a tax-free grant, this may change in the future. Is a PPP Loan for Self-Employed considered taxable income?

#Blue acorn ppp loan login plus#

2020 Capital Plus Financial Partners with Blueacorn to.

#Blue acorn ppp loan login update#

With the updated guidance allowing 2.5 months’ worth of net income as OCR, meaning your entire PPP loan might be used for private purposes-essentially free money. PPP/SBA LOAN UPDATE BLUE ACORN,WOMPLY SECOND DRAW FUNDING Web14 sept. Is a PPP Loan basically free money?Įssentially, Yes! For the purposes of the PPP Loan, you are considered the employee and your loan amount is used to pay yourself.

#Blue acorn ppp loan login full#

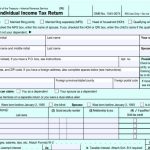

When you complete the EZ Forgiveness application, you’ll enter the full loan amount on Line 1.

Here are the main points on full loan forgiveness for self-employed people up to 20,833. In light of latest PPP guidelines, self-employed people and independent contractors now get the whole loan forgiven automatically. There are no special conditions for self-employed people to follow. you’ll simply transfer the full loan amount to your personal checking account . Self-Employed People Get Automatic PPP loan Forgiveness. How much am i able to claim?Īssuming your PPP loan didn’t include other payroll expenses, this amount covers your entire PPP loan. The maximum amount is $20,833. Usually these are Sole Proprietors, Independent Contractors and owners of Single Member LLC’s. Who gets automatic PPP Loan forgivenessĪnyone who applied for their loan using their Schedule C can file for automatic forgiveness. Here are the main points on full loan forgiveness for self-employed people up to $20,833.

#Blue acorn ppp loan login drivers#

Blueacorn saw enormous demand during this period, ultimately supporting 808,000 small business owners / sole proprietors via disbursement of $12.5 billion in SBA PPP funds.īlueacorn’s borrowers were the people who keep our economy running and weave together the fabric of our communities: beauty salon owners, truck drivers who are operating their business off their phone in between stops, our favorite local coffee shops and restaurants that define our neighborhoods, residential construction workers, rideshare or taxi drivers, landscapers, and local delivery workers, among a variety of other professionals.In light of latest PPP guidelines, self-employed people and independent contractors now get the whole loan forgiven automatically. Many were also unwilling to lend to individuals altogether.īlueacorn was founded in April 2020 with the singular purpose of advancing the original mission of PPP by democratizing access to loan relief for America’s small businesses, independent contractors, and self-employed workers – groups who are often overlooked by our traditional banking system and could not seek relief through the traditional PPP channels.Īs a fintech lender service provider, Blueacorn partnered with the Small Business Administration (SBA) and CDFIs to facilitate the application for and fulfillment of PPP loans predominantly for businesses and workers who qualified as independent contractors, self-employed individuals, freelancers, and gig workers. However, due to the structure of the program, it became clear that there was a growing divide when it came to loan disbursement, with lenders prioritizing applications for clients who would take out the largest loans and bring in the highest fees. The launch of PPP was met with enormous demand and the program was renewed two times to meet the flood of applications. This table shows the top 5 industries in Pennsylvania by. Search more than 11 million loans approved by lenders and disclosed by the Small Business Administration. Pennsylvania has a total of 342,352 businesses that received Paycheck Protection Program (PPP) loans from the Small Business Administration. As part of the Paycheck Protection Program, the federal government has provided hundreds of billions in financial support to banks to make low-interest loans to companies and nonprofit organizations in response to the economic devastation caused by the coronavirus pandemic.

PPP was designed to be an intentionally untargeted program with limited safeguards in place so as to prioritize reaching those in need as quickly as possible. PPP Loan Recipient List By State Pennsylvania.

Given the severity of the threat posed by COVID-19, the government sought to create a program that focused on speed and access. PPP was a cornerstone program of the CARES Act, intended to help employers keep their employees on their payroll by covering up to two months of their payroll expenses with a loan that could be completely forgiven if it was spent in accordance with the program’s guidelines.

0 kommentar(er)

0 kommentar(er)